Moomoo is an online broker specialising in US and Hong Kong stock trading. It provides a fully digital brokerage service and wealth management platform alongside a top-class user experience. This Moomoo review will cover customer service options, how to open an account, fees, trading quotes, minimum deposit requirements, and more.

Moomoo Headlines

Moomoo Inc is a subsidiary of Futu Holdings Ltd and was established in March 2018. The broker’s mission is to provide investors with an intuitive and powerful investment platform backed by innovative technology. Primarily aimed at US and Chinese investors, Moomoo is regulated and authorised by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). In Singapore, the service is regulated by the Monetary Authority of Singapore (MAS).

Moomoo’s parent company, Futu, is backed by notable investors, including Tencent, Matrix, and Sequoia.

Trading Platform

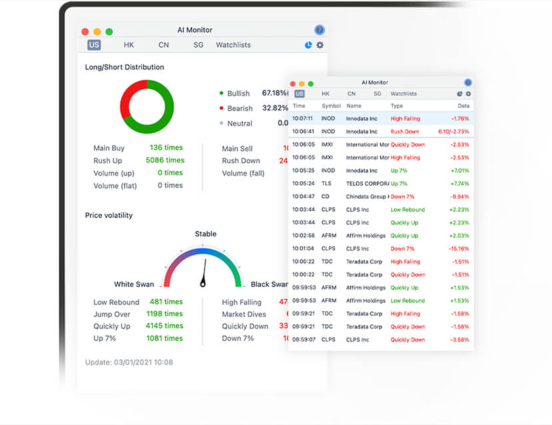

Moomoo offers a proprietary trading platform that is suitable for both new and experienced traders. Clients can download the platform to desktop devices and it’s compatible with Windows and Mac. There is no web browser compatibility.

Features include:

- Profit & loss analysis

- 62 technical indicators

- Portfolio and fee reports

- 22 powerful drawing tools

- Customisable user interface

- Conditional alerts and notifications

- Ticket or asset search function with auto suggestion

- Several order types, including limit, market, stop, stop limit, trail limit

Visit the Moomoo website for a downloadable platform guide.

Products

Moomoo offers clients investing and trading opportunities in over 5000 shares and ETFs. Stocks from the following markets are available:

- China – A-shares via the Hong Kong Exchange

- Hong Kong – Stocks and ETFs via the Hong Kong Exchange

- US – Stocks, options, ETFs, ADRs, OTC, U.S, IPOs via the NASDAQ, NYSE and Chicago Mercantile Exchange

Clients can speculate on the some of the biggest global brands using a suite of analysis tools. Head to the ‘additional features’ section below for more details.

Fees

With Moomoo, stocks, ETFs, and options trading are commission-free for US residents. However, regulatory charges are applicable, for example, the US Securities and Exchange Commission (SEC) charges a small fee for stock sell orders. This is not broker-specific and the rate is negligible (0.0000051 x transaction amount at the time of writing). Other charges include trading activity fees ($0.002 per contract, min $0.01 per order), an options regulatory fee ($0.0378 per contract) and OCC fees ($0.02 per contract (0-2750 contracts) or $55.00 per trade (>2750 contracts).

For Hong Kong stocks and China A-shares, there are commission fees. These are charged at 0.03% or 3 HKD/3 CNH (whichever is higher). There is also a 15 HKD /15 CNH per order platform fee and various regulatory charges including stamp duty, trading tariffs, and exchange settlement fees. A full fee schedule is available on the broker’s website.

Crucially, there are no account opening fees, maintenance charges, or inactivity fees, meaning traders can calculate profits on a per-trade basis. Vs competitors such as WeBull, Interactive Brokers and eToro, the fee structure is easy to understand.

Moomoo Leverage

Margin trading is available on US stocks up to a maximum of 1:2. However, if your net assets are less than $2,500, this option may not be available. The annual margin rate (i.e interest on borrowed funds) is also fairly high, at a flat rate of 6.8% vs 2.5% at Robinhood.

Margin trading is a risky strategy. Traders can lose more than their initial deposit, so consider if this is right for you before trading.

Mobile Trading

Moomoo’s big selling point is its intuitive mobile app. This is available for free download to iOS and Android devices from the relevant app store. Alternatively, there are QR codes on the broker’s website for easy download.

It is a feature-rich platform, offering real-time charts and full trading history. Plus, it provides access to all analytical functions, including economic data releases and earnings calls, so you can review investments on the go. The Moomoo app is available in English or Chinese language.

Other notable features include:

- Trackable trade notes

- Multiple customisable charts

- Ticket or asset search function

- Alerts and notifications available

- User-friendly with easy navigation design

- Technical and fundamental analysis on trading companies

- Several order types, including limit, market, stop, stop limit, trail limit

Payments

Deposits

Moomoo does not have a minimum deposit requirement, which is ideal for new traders. Account funding currencies include USD, HKD, and CNH.

Accepted payment methods:

- Automated Clearing House (ACH) Transfers – US bank accounts only, no deposit fee, 5 business days settlement, maximum deposit $5,000 per transaction

- Domestic Bank Wire Transfer – $10 fee plus bank charges (no more than $50 estimated), 1-3 business days settlement

- International Bank Wire Transfer – $10 fee plus bank charges (no more than $70 estimated), 1-3 business days settlement

Instant buying power is available interest-free on US stocks and IPOs. This provides every trader with a $1,000 limit, which can be increased to $2,000 if there are adequate assets in your account. Instant buying power is available as soon as your deposit clears or within 7 days of the initial grant.

Withdrawals

Moomoo does not charge a withdrawal fee for ACH transfers, however, bank wires do incur a $25 fee, plus any bank charges. Withdrawals via bank wire transfer are only available in USD. Clients must use the currency exchange on the platform to convert before withdrawing.

The maximum withdrawal amount is $10,000, however, traders can initiate several transactions. Average processing times are up to five business days.

Demo Account

Moomoo offers a free demo account across all instruments. Also known as ‘paper trading accounts’, demo solutions are a good way to familiarise yourself with the platform features and test strategies risk-free. Pre or after-hours trading is not permitted via the demo account.

Sign Up Bonuses & Promotions

Regulation

Moomoo is regulated by the US Securities and Exchange Commission (SEC). This is a credible regulatory body in financial services, requiring stringent client protection protocols. Moomoo is also a member of FINRA and the Securities Investor Protection Corporation (SIPC), with up to $500,000 in compensation available for clients in the case of financial failure.

In Singapore, Futu Singapore Pte Ltd, the Moomoo subsidiary, is a registered capital markets license holder with the Monetary Authority of Singapore (MAS). Moomoo’s parent company Futu Holdings Limited is also listed on the NASDAQ stock exchange, providing additional credibility.

Additional Features

As a Moomoo user, clients can access the global investment community which has more than 200,000 users worldwide. Investors can share trading insights with community members and participate in transaction discussions. The broker also offers 24/7 live global financial news and stock price fluctuation updates. Economic data and a financial calendar are published on the broker’s website. Moomoo also supports retail clients with free level 2 market data, providing valuable insights with real-time bids and asks from NYSE Arcabook.

In addition, Moomoo facilitates superior trading analytics via profit & loss diagrams, powerful drawing tools, and asset ranking statistics. Educational information can be accessed via the help centre. This includes financial analysis, a stock academy, calculation tools, technical analysis, and a tutorial on how to calculate the cost basis of positions.

Live Accounts

Moomoo offers retail clients just one account option, the Individual Margin Account. There is no minimum deposit requirement and no option for a joint account. We would recommend consulting the broker’s customer service team for more information or utilising the paper trading account beforehand.

Clients can open a new account via the mobile app or on the Futu Inc website. Identity and address verification is required in order to comply with the Know Your Customer (KYC) checks. Applications are generally processed on the same day.

Benefits

- Demo account

- Intuitive mobile app

- Bonuses and financial incentives

- No minimum deposit requirement

- ‘Moomoo Token’ transaction security

- Superior trading analytics and insights

- Access full extended pre-market trading hours

- Regulated by US Securities and Exchange Commission (SEC) and the Monetary Authority of Singapore (MAS)

- Member of FINRA and the Securities Investor Protection Corporation (SIPC), with up to $500,000 in compensation against broker insolvency

Drawbacks

- High margin rate fees

- No phone or live chat support

- No negative balance protection

- No 2 factor authentication (2FA)

- No MT4 or MT5 trading platforms

- Aimed mainly towards US residents

Trading Hours

Moomoo follows standard Monday-Friday trading hours, however, these timings may vary by instrument. The broker’s website details market holiday hours. Pre and after-market trading hours are also available on some assets. The following times are applicable to US assets:

- Pre-market hours – 4 am to 9:30 am (EST)

- Regular hours – 9:30 am to 4 pm (EST)

- After-market hours – 4 pm to 8 pm (EST)

Customer Support

Moomoo offers customer support through the following channels:

- Email – support@moomoo.com

- Social media – Twitter and Facebook

- Address – 720 Univesity Avenue, Suite 100, Palo Alto, CA 94301, USA

The FAQ help centre on the Moomoo website is a great place to find answers to common questions. It includes a user guide on how to withdraw funds, options fees, and various trading strategies. There are also self-help guides to help you resolve issues, such as how to unlock trades or understand the reasons for being unable to withdraw.

Security

The Moomoo trading platform assures high-tech encryptions and industry-standard data privacy. However, there is only one-step login for mobile and desktop platform access. Biometric or 2 step-login authentication would be more secure given the broker prides itself on its technology.

Despite this, ‘Moomoo Token’ can be enabled to provide an additional layer of security. This is a separate app that can be downloaded from any app store. It provides dynamic password verification, creating a new 6-digit code every 30 seconds for monetary transfers.

Moomoo Verdict

Moomoo is a reliable, easy-to-use proprietary terminal suitable for new or experienced investors. There are no minimum deposit requirements, making it ideal for those with lower capital requirements. A demo account is provided and sophisticated analysis tools are available. However, the product portfolio is very limited. Plus, we would like to see the integration of 2-factor login security features to enhance client protection and more customer services options. Overall though, we believe Moomoo is a strong contender.

FAQs

Is Moomoo A Legit Broker?

Yes, Moomoo is regulated with a credible authority – the SEC and provides a user-friendly trading platform. Investor protection is offered by SIPC, up to a maximum of $500,000, including a $250,000 limit for cash in the case of business insolvency.

Is Moomoo Regulated?

Yes, Moomoo is regulated and authorised by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) in the US. In Singapore, the service is regulated by the Monetary Authority of Singapore (MAS).

Does Moomoo Charge Trading Commissions?

Moomoo offers US stocks with zero commissions. Regulatory charges are applied, but these are not broker specific. Hong Kong stocks incur a commission of 0.03%/3 HKD/3 CNH (whichever is higher).

What Is The Moomoo Buying Power?

Moomoo provides instant interest-free ‘buying power’ up to $1,000 whilst account funding is settling. This is cleared after 7 days or after a deposit settles as withdrawable cash.

Can I Open A Moomoo Trading Account In The UK?

Moomoo trading accounts are currently targeted towards US residents and are not available to clients in the UK. This is similar to TD Ameritrade, which offers no trading options to UK or EU residents.

Moomoo Vs Futu, What Is The Difference?

Moomoo Inc is a subsidiary of Futu Holdings Ltd, founded in March 2018. Futu is the parent company with global trading operations.

Accepted Countries

Moomoo accepts traders from Australia, Thailand, Canada, United States, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use Moomoo from United Kingdom.