About BDSwiss

BDSwiss was established in 2012 and offers Forex and CFD trading.

You can reach BDSwiss by phone on a range of numbers available on their ‘contact us’ page

The brand also offer the ‘sub-zero account‘. This allows traders to let their account balance go below zero – effectively offering credit. This might prove a useful feature for traders looking to act quickly after spotting an opportunity.

Terms and conditions apply, and traders need to use the feature responsibly.

BDSwiss Trading Platform

BDSwiss boast a bespoke platform that delivers FX/CFD, where a free demo account is also available.

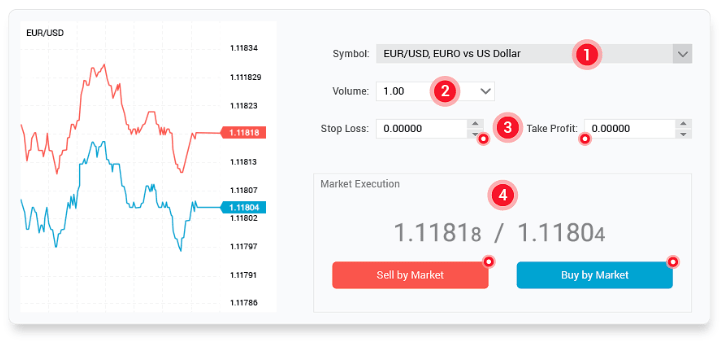

How To Place A Trade At BDSwiss

- Select the asset or market – Choose from Forex, commodities or indices for example

- Select the volume – The size of the trade, tailor it to manage risk and reward

- Set any risk management levels – stop loss or take profit

- Select the direction of the price – Will the price rise or fall?

BDSwiss offer 250+ assets to trade, and with markets operating around the globe, the platform is available 24/7

BDSwiss Charts

The trading charts on the platform use Line or Candlestick format. You may also choose among the following time frames: 1, 5, 15, 30, 60 minutes and 4 hours, Daily, Weekly and Monthly.

A number of indicators that can be directly inserted to your charts are:

- Moving Averages

- RSI

- Bollinger Bands

- ATR

- MACD

- Fibonacci Retracements.

The platform for the Forex trading very advanced. You can integrate to MetaTrader 4 with loads of indicators, technical tools and many more settings.

Trade Types

BDSwiss offer CFDs and traditional spot forex trading.

BDSwiss Trading Software and Features

Payouts

Payouts will vary based on performance of the underlying asset. The use of stop losses and take profit orders can ensure some structure and limits when trading. This allows traders to monitor their risk.

Asset Index

The asset list at BDSwiss covers forex, commodities and indices (as well as some treasuries). There are over 250 assets including cryptocurrencies such as Bitcoin, Ethereum and Litecoin.

Customer Support

Live chat is available in English, German and Italian which is very good. All you need to access the live chat is an email address and a user name. Telephone and email support is also available – telephone support is delivered locally in 16 different nations.

BDSwiss Terms & Conditions

Always check the terms and conditions of the firm you wish to deposit with. We have reviewed those at BDSwiss and would highlight the following:

A dormant account fee is applied after 6 months which is more than enough time to learn and have the time to be active on the platform. If however you remain inactive after 6 months, a 10% fee will be deducted from your account ranging from minimum 25 Euros but NOT more than 49.90 Euros.

Withdrawals

BDSwiss offer very quick withdrawals, with processing normally taking place within 24 hours – though some methods may take 2 or 3 days. They recently added to their range of deposit options (wire transfer, debit and credit cards and e-wallet solutions). They want traders to be able to use local, familiar payment methods, so offer a good spread of deposit choices.

Free Signals

BDSwiss recently opened a new service for clients – offering free trading alerts. In addition the signals themselves, the service also includes entry and exit points. This allows traders to better judge the quality and strength of the signals – plus the all important element of timing.

Signals can lead to over trading, but as these are offered free, they are a low risk way to try them out and see how accurate they are long term.