Founded in 2009, XM is a globally recognized forex and CFD broker that caters to traders from over 190 countries. Known for its strong regulation and wide range of trading products, XM has grown to be one of the most trusted brokers, with more than 5 million clients worldwide. They offer a variety of account types, multiple platforms, and a vast array of instruments, making it suitable for both novice and experienced traders.

Regulation and Security

XM operates under some of the most reputable regulatory bodies, ensuring the safety and transparency of its services. Below is an overview of the regulatory framework that governs XM:

| Regulatory Body | Region | License Number |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | 120/10 |

| Australian Securities and Investments Commission (ASIC) | Australia | 443670 |

| International Financial Services Commission (IFSC) | Belize | IFSC/60/354/TS/19 |

| Financial Conduct Authority (FCA) | United Kingdom | 705428 |

| Financial Services Commission (FSC) | Dubai | F003484 |

This regulation helps ensure traders can invest with confidence, knowing that their funds are protected through practices like client fund segregation and negative balance protection.

Account Types

XM provides a range of account options to accommodate different trading preferences and experience levels:

| Account Type | Minimum Deposit | Leverage | Spreads | Commission | Best For |

|---|---|---|---|---|---|

| Micro Account | $5 | Up to 1:888 | From 1 pip | None | Beginners |

| Standard Account | $5 | Up to 1:888 | From 1 pip | None | General traders |

| XM Ultra-Low Account | $50 | Up to 1:888 | From 0.6 pips | None | Low-cost traders |

| Shares Account | $10,000 | 1:1 | Variable | None | Stock traders |

Each account type has specific features, allowing traders to select the best fit for their strategy and risk tolerance.

Trading Instruments

XM offers a diverse portfolio of financial products, enabling traders to diversify their investments across different asset classes:

| Asset Class | Available Instruments |

|---|---|

| Forex | 55+ currency pairs |

| Commodities | Oil, coffee, sugar, etc. |

| Indices | Global indices (US30, GER30) |

| Stocks | 600+ individual stock CFDs |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, etc. |

| Metals | Gold, Silver |

| Energy | Oil, Natural Gas |

This broad selection allows for robust diversification across multiple financial markets.

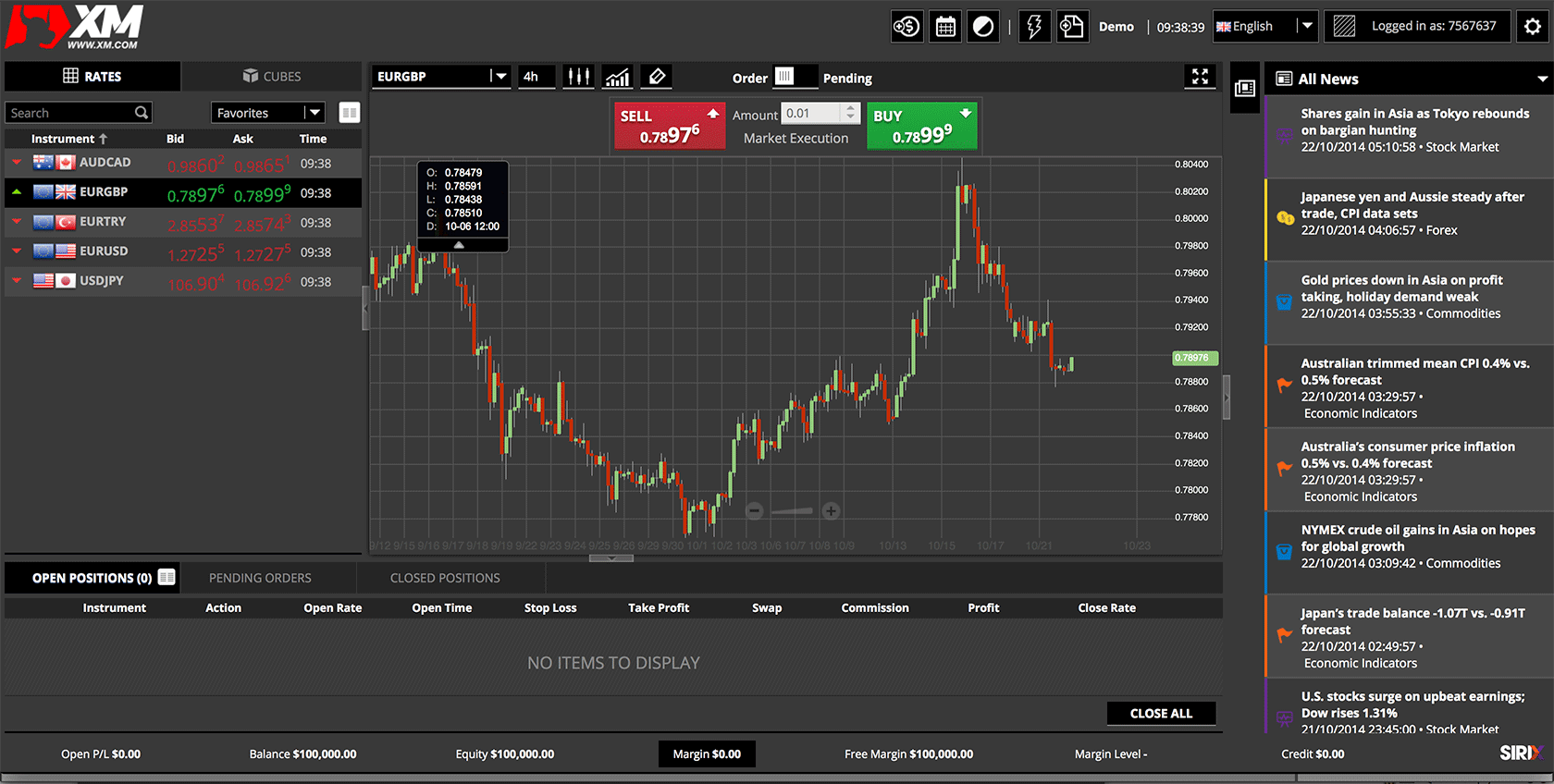

Trading Platforms

XM provides access to the industry’s most widely-used trading platforms as well as its proprietary mobile app, XM Trading Point:

| Platform | Key Features |

|---|---|

| MetaTrader 4 (MT4) | Supports EAs, over 50 indicators, one-click trading |

| MetaTrader 5 (MT5) | Advanced charting, additional timeframes, full market depth |

| WebTrader | Accessible via browsers, no downloads required |

| XM Mobile App | Fully functional mobile trading on both iOS and Android |

These platforms are known for their robust features, providing traders with flexibility and convenience.

Spreads and Fees

XM offers competitive spreads, with no hidden fees. They charge no commission on most account types, and the trading costs are built into the spreads:

| Account Type | Spreads |

|---|---|

| Standard Account | From 1 pip |

| XM Ultra-Low Account | From 0.6 pips |

XM also does not charge fees for deposits and withdrawals, making it an affordable choice for all traders.

Deposit and Withdrawal Options

XM offers several convenient payment methods to cater to traders from different regions:

| Method | Processing Time |

|---|---|

| Credit/Debit Cards | Instant |

| Bank Transfer | 2-5 business days |

| E-wallets (Skrill, Neteller) | Instant |

XM ensures that most withdrawal requests are processed within 24 hours, with e-wallet transactions being the quickest.

Customer Support

XM offers multilingual customer support through various channels, ensuring traders can access help whenever needed:

- Live Chat: Available 24/5 for immediate assistance.

- Email: Multilingual support via email.

- Phone: Direct and personalized support for complex queries.

This ensures a smooth experience, regardless of the trader’s location or time zone.

Educational Resources

XM provides an extensive collection of educational tools to help traders improve their skills:

| Resource | Description |

|---|---|

| Webinars | Live sessions with trading experts |

| Video Tutorials | Step-by-step platform and strategy guides |

| Daily Market Analysis | Insights on key market trends and technical analysis |

With XM live webinars, traders can access real-time market analysis and expert advice, while the platform’s video tutorials cater to beginners and advanced traders alike.

Conclusion

XM stands out as a reliable and well-regulated broker that caters to traders of all experience levels. Its comprehensive range of trading instruments, flexible account types, and competitive spreads make it an ideal platform for both casual and professional traders. The broker’s commitment to providing educational resources, along with strong customer support, ensures a seamless and informed trading experience.